Knowledge Hub

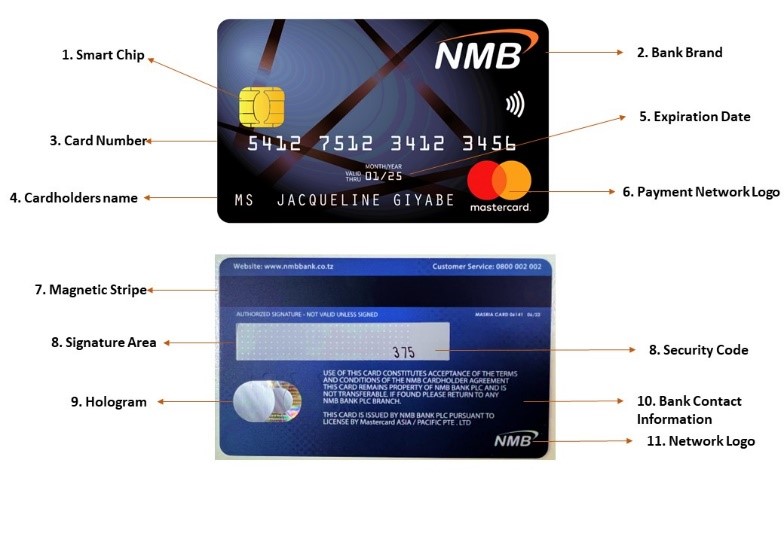

Know your card

How to start using your bank account

Congratulation on opening NMB bank account; here are the things you should consider after opening a bank account

Secure your PIN – do not share your PIN with a friend, colleague or even a bank officer

A PIN is 4 digits security code that you set when opening the account.

There are two types of PIN,

- ATM card PIN – a 4-digit number that you require for transactions at an Automated Teller Machine (ATM machine) or this PIN can be used when making purchases on Point of Sale machine at a convenient store.

- Mobile Banking PIN also known as NMB Mkononi PIN, is a 4-digit PIN used to access and operate your NMB mkononi. NMB Mkononi service or mobile banking is accessible via USSD *150*66# or by downloading NMB Mkononi App in play store or APP store.

- How to know your bank account number

- Written on your ATM card – it’s 11 numbers which appear on the front of your ATM card

- Your account number is also appears when your login to your NMB Mkononi APP or checking your balance on NMB Mkononi USSD *150*66#.

|

FRONTEND |

BACKEND |

|

|

What are things you can do with your bank account along with your ATM card and NMB Mkononi services?

-

- Direct deposit

- Buy airtime

- Pay bills such as buying LUKU, water bills

- Pay school fees direct cost using control number

- Make various government payments

- Cash withdraw

How to transact

- Ways to access your cash deposited into your bank account

-

- Cardless withdrawal (Pesafasta) – you can withdraw cash without using your ATM to nearby NMB wakala or nearby NMB ATM; cardless withdrawal allows your family and friend to withdraw cash that you send directly to NMB ATM or NMB wakala without them having a bank account. You need to activate your NMB mkononi service before using this service.

- Cash withdraw - you can withdraw cash using your ATM card at any ATM machine with a mastercard logo in the country.

- Mobile fund transfer from your account to a mobile wallet (Mpesa, Tigopesa etc.,)

- Different ways that you can fund your account

-

- Direct deposit – through NMB wakala or NMB branch

- Fund transfer from mobile wallet (e.g. Mpesa, tigo pesa) to your NMB account

- Other bank transfer

Note you need to know your bank account number before making fund transfer.

- Common challenges when accessing your account

- Insufficient fund when accessing *150*66#; occurs when you don’t have airtime balance; hence requires to buy airtime.

- Use original Simcard – when activate NMB Mkononi APP; this occurs to smartphones with 2 simcards and simcard registered to NMB mkononi is not set as primary card for receiving calls, SMS and data. Set your NMB mkononi simcard as primary card when activating the NMB Mkononi APP.

- How to make purchase

- Online purchase – you can buy books, and subscriptions using your card by entering 16 digits card number and CVV code; note you need to visit a branch to request permission for your debit card (i.e. card linked to your bank account) to transact online; if you have prepaid card you can transact without requesting permission at the branch

- POS purchase – use your debit, credit or prepaid card to buy goods at your convenience shop, supermarket, or petrol station that have merchant POS

- Lipa Mkononi (QR) – use your NMB Mkononi to scan QR code to buy goods/services.

NMB Mkononi

- How to activate NMB Mkononi service

- When opening NMB ChapChap account or Mwanachuo account by our field agents or

- At the branch

- NMB ATM machine self-registration

- Features of NMB Mkononi

-

- Display account balances and details in real-time.

- Ability to send money to other Banks, NMB Accounts and MNOs instantly.

- Complete online funds transfers and external transfers.

- Withdraw my cash any time anywhere.

- Paying different bills.

- Get forex info and transfers.

- Send or receive secure messages checking.

- Provides ability to withdraw without ATM Card

- Who qualifies for NMB Mkononi?

All NMB Customers with NMB ATM cards can register for NMB Mkononi

- How to update?

Go to play store (Android) or APP store (IOS), search NMB Mkononi then click update.